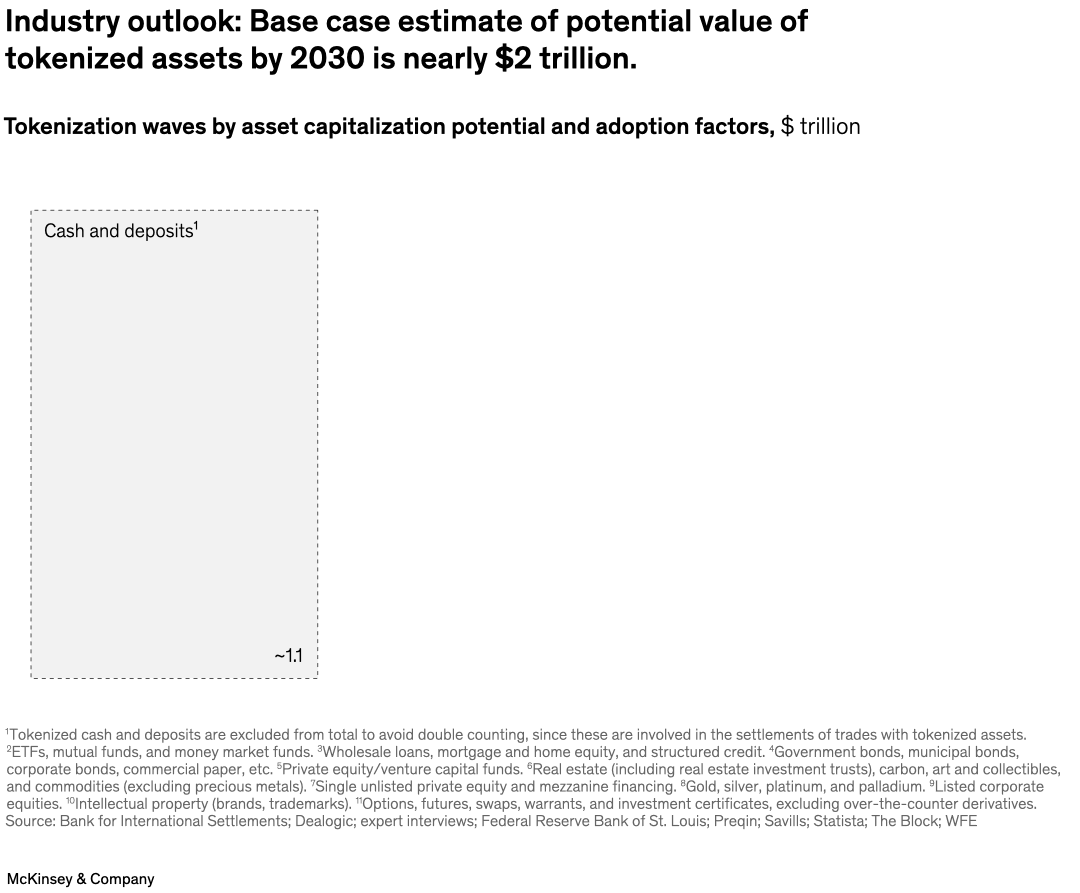

Tokenization, the process of creating a unique digital representation of an asset on a blockchain network, offers many benefits for the financial system: it’s efficient, transparent, and secure. Partner Anutosh Banerjee and colleagues predict that tokenization will likely occur in waves, beginning with asset classes that are technically and regulatorily feasible and where efficiency and value gains are relatively large. These include cash and deposits, mutual funds and exchange-traded funds, loans and securitization, and bonds and exchange-traded notes.

To read the article, see “From ripples to waves: The transformational power of tokenizing assets,” June 20, 2024.